Nothing is more concerning than having a little one experience a medical issue and not knowing the level of severity. Children can’t always communicate what’s wrong, which can cause them to feel frustrated and emotional on top of the pain they’re feeling. It’s hard to know how to handle it.

As a father of three kiddos, I can tell you firsthand how thankful I am to be able to rely on pediatricians’ medical care and expertise.

Fortunately, pediatricians are extremely well-trained and love what they do. But while their job satisfaction ranks among the highest of physicians, their pediatrician salary doesn’t.

We’re going to take a look at the salaries of general and subspecialist pediatricians. We'll also examine the student debt they carry and their loan repayment options.

Pediatricians have high job satisfaction

Medscape puts out a comprehensive pediatrician survey each year that includes compensation data. The Medscape Pediatrician Compensation Report 2022 survey shows that pediatricians rank very high among job satisfaction and quality of life.

Seventy percent of pediatrician respondents would still choose a career in medicine, and 84% said they would choose the pediatric specialty again. Along with that, pediatricians have relatively manageable patient loads and report working about 38 hours per week seeing patients.

When asked about the most rewarding part of their job, 34% cited their relationship with patients. Additionally, 29% said they feel that they’re making the world a better place.

The pediatrician that we take our kids to in St. Louis is extremely passionate and really cares about our kids. His dad was a pediatrician, and his wife is, as well. I have two other really good friends in pediatrics, and they are also great.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Pediatrician salary ranks low compared with other physicians

According to the Bureau of Labor Statistics (BLS) latest data (May 2022), the annual mean wage for a general pediatrician is $203,240. Top paying industries are broken out into the following categories:

- Local Government (excluding schools & hospitals) – $236,850

- Outpatient care centers – $225,370

- Offices of physicians – $213,230

- Specialty hospitals (excluding psychiatric and substance abuse hospitals) – $211,260

- Medical and Diagnostic Laboratories – $200,790

However, Medscape's survey paints a more detailed compensation picture when comparing pediatricians with other types of physicians.

Medscape reports the average pediatrician salary as $244,000, which is significantly higher than BLS findings. Other physician specialties like orthopedics, cardiology and dermatology make an annual wage over $400,000. Pediatrics ties for last place with physicians who work in public health and preventative medicine.

Other factors affecting pay include whether a pediatrician is self-employed versus working for an employer. We can also see a difference in pay by states, too.

According to ZipRecruiter’s average pediatrician salary by state, Oregon pays the most at $222,171. Whereas Florida is the lowest at $133,219. There are 9 states that pay in above $200,000, including Hawaii, Nevada, Massachusetts, South Dakota, Colorado, Rhode Island, Alaska, North Dakota and Washington.

Yes, there are a large proportion of remaining states that are lower than the stated average. But that’s because the pay is normalized to an hourly rate. This income represents working 40 hours a week for 52 weeks. Nevertheless, it does show which states pay better than others. Keep in mind that the average annual salary might vary by metropolitan areas, as well.

Despite the lower pay, 47% of pediatricians feel that they are fairly compensated, according to the Medscape survey. Their job satisfaction rate more likely has to do with their love for helping people than their pay. Nearly half feel like they should be earning more for the work they do.

General pediatrician salary vs. pediatric specialists

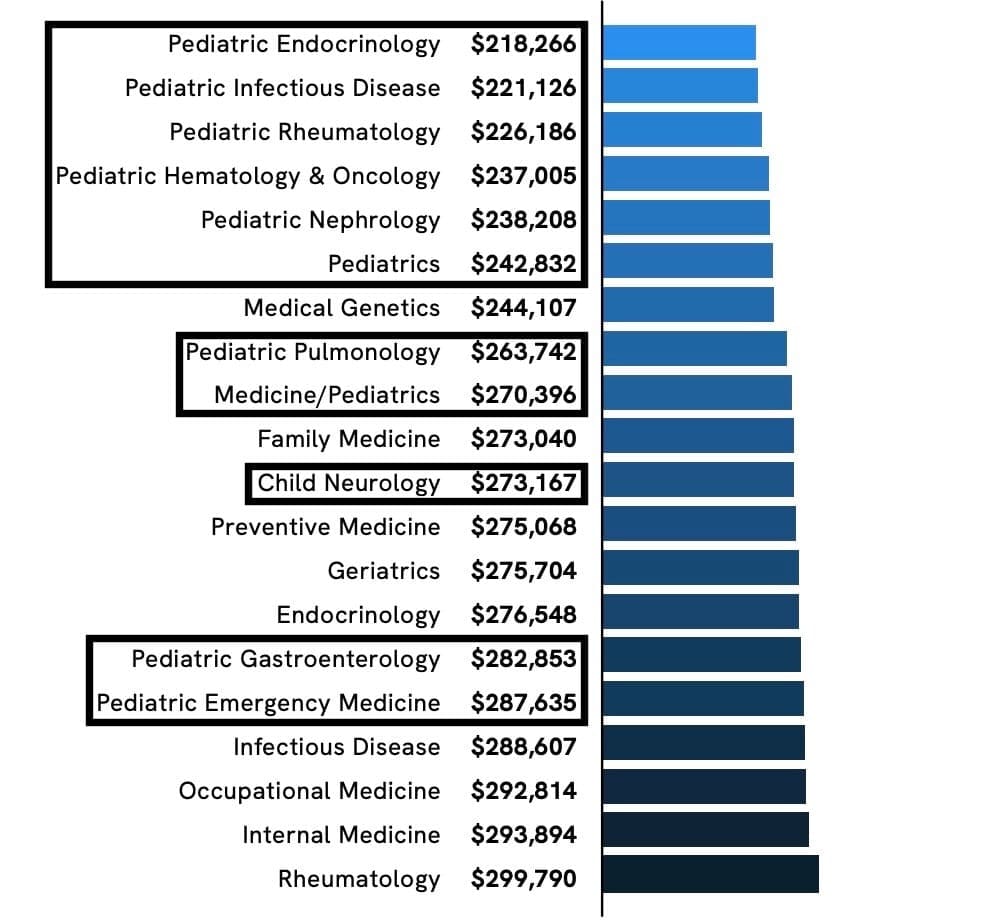

Doximity came out with its 2023 Physician Compensation Report breaking down the income of physician salaries and providing information about various pediatric specialties. Doximity reported that the average pediatrician salary is $242,832, which is close to the average salary Medscape reported.

How does that compare to the pediatric subspecialty occupations though? Just like in all medicine, specialists tend to earn more than generalists, with a couple exceptions. Here’s a look at the chart from Doximity 2023 report where you can see the lowest average annual compensation specialties, many of which follow into pediatric subspecialties:

The only pediatric specialties that earn less than a general pediatrician are nephrology, hematology and oncology, rheumatology, infectious disease, and endocrinology.

Emergency medicine, gastroenterology, and neurology are the three highest compensated pediatric specialties — and for good reason. These are some of the most challenging specialties both in terms of the work and the emotional toll it can take helping kids in very volatile health conditions and distress every day.

The chart above consists of the 20 lowest compensated specialties across all physicians, not just pediatricians. In contrast, no pediatric specialties were listed in the highest average annual compensation top 20 specialties chart.

Additionally, the 2023 survey noted that pediatric cardiologists have one of the larger gender wage gaps. Male pediatric cardiologists averaged $282,272 per year, while female pediatricians averaged $227,958.

Any disparity in fair pay, whether gender-related or geographic can make paying off medical school loans more difficult. Let’s talk about student debt and how to approach loan repayment based on what we know about the physician compensation data.

How to manage pediatrician student loan debt

According to the Association of American Medical Colleges, the median 4-year cost of attendance for class of 2023 physicians owes $268,476 (public school) and $363,836 (private school), respectively. I believe that number is wildly understated.

Why? Here at Student Loan Planner®, we’ve done 1,658 physician consults, and the stats on their debt is more than 60% higher. The average physician who consults with us has over $322,000 in student loans.

Pediatricians often have loans at close to or exceeding twice their income, which can make loan repayment more challenging.

Optimal medical student loan repayment strategies

When we talk about student loan repayment, it’s really important to go all in on one of two strategies:

Strategy 1: Pay off the loans as quickly as possible

This payoff strategy works best for pediatricians who owe 1.5 times their income or less. For example, pediatricians with $300,000 of student loans or less and earning $200,000. It's also for those who aren’t looking to go for Public Service Loan Forgiveness (PSLF).

The idea here is to get a lower interest rate by refinancing. Then, pay off the loans aggressively in 10 years or less.

Strategy 2: Keep payments as low as possible and maximize loan forgiveness

This method works best for pediatricians who work for a nonprofit or government employer (e.g. state or local government) full-time and owe more than twice their income in student loans.

Someone in this situation would want to get on an income-driven repayment plan that will keep their payments as low as possible and take advantage of retirement plans and other things that will reduce their adjusted gross income.

In the end, they’ll spend the least amount out of pocket and get as much debt forgiven as possible, whether it’s taxable on an income-driven plan for 20 to 25 years or tax-free with PSLF.

It is very important to pick one of these two options. Doing something in between, like refinancing and paying off the loan over 15 years or making extra payments while on an income-driven plan, could be extremely costly.

How to get PSLF for pediatrician medical school debt

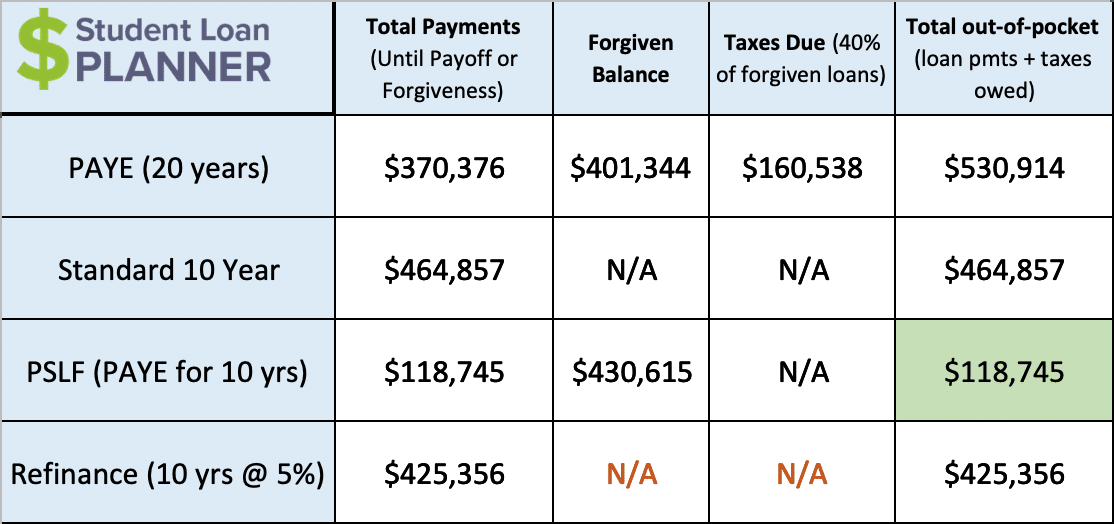

Nearly 50% of pediatricians work at an employer that qualifies them for PSLF. Here’s an example of how a physician in that situation might approach loan repayment.

Let’s say that Julia is a first-year resident with $327,000 in student loans at 6.8% and earning $50,000. Her income will go up $2,000 per year while in residency, then jump to a pediatrician salary of $210,000 when she becomes an attending at a nonprofit hospital:

PSLF results in monster savings for Julia. She’ll end up making total payments of $118,745 on PAYE over a 10-year period and have the rest of her loans forgiven tax-free. The next best option would be refinancing, but it’s a massively distant second place, costing about $307,000 more to pay off her loans. Refinancing instead of going for PSLF would cost her nearly three times the amount.

Now, this doesn’t necessarily mean that she should take a PSLF-qualifying job just to get that benefit. We have to run the numbers and take a look at the extra cost of refinancing versus the extra post-tax pay.

Let’s say that Julia was considering her job as an attending making $210,000 or a private practice job making $259,000. She’d probably have an extra $3,000 per month ($36,000) in take-home pay after taxes working in the private practice.

Let’s say that the $307,000 difference is spread out over seven years. That would be about $44,000 per year in extra payments. If her after-tax pay is $36,000 more in private practice but she’d have to spend $44,000 more to pay off her loans, she’d lose about $8,000 per year by taking the private practice job over those seven years.

From a purely mathematical perspective, taking the lower-paying job for those seven years would be worth it to get PSLF. She’d still have the opportunity to move to private practice if she wanted and get the higher pay once she’s free of her student debt.

In that situation, she’d have to earn close to $70,000 more, in order to justify giving up PSLF from a financial perspective.

Loan repayment strategies for pediatricians in private practice

Half of all pediatricians work in private physicians' offices, whether they’re on their own or in a group. Private jobs generally have higher salaries, and if a pediatrician becomes a practice owner, that will increase their pay too.

In Julia’s scenario, if she’s making $259,000 in private practice and owes $327,000 in student loans, refinancing and paying off the loans in 10 years or less will save her the most money, assuming she’s not considering working for a PSLF-qualifying employer.

Her debt-to-income ratio is below the 1.5 times mark, so she just needs to pay the loans off as fast as she can. Her payments would be around $3,500 per month for a 10-year refinance at 5%.

Why refinance? If she pays back 6.8% on her debt over 10 years, it will cost her an extra $40,000 ($300+ per month) paying back her loans than if she paid them off over the same period but at a 5% interest rate. She’d much rather keep that extra $40,000 than pay the extra interest, and we’d much rather she keep that money too.

How to pay back student loans with any pediatrician salary

I outlined some general parameters on how to pay back student loans. If a pediatrician owes less than 1.5 times their income in loans and isn’t planning to go for PSLF, then refinancing is the way to go. I'd suggest applying through our cash-back refinancing links if you’re in that situation.

But if a pediatrician owes more than twice their income in student loans or is going for PSLF, there could be five- to six-figures of extra expenses lost to being on the wrong plan. The good news is that there’s an optimal plan whether you become a general pediatrician or a subspecialist and whether you are going for PSLF or not.

Also, keep in mind that your pediatrician salary will make it easier to accomplish life milestones like becoming a homeowner, thanks to pediatrician mortgage loan options.

Here at Student Loan Planner®, we’ve done more than 10,000 consults and have advised on over $2 billion of student loans. Our goal is to make sure that you have a solid student loan plan that fits with your chosen career and life goals.

We can help you figure out an optimal plan in just one hour and be there to help support you even after we get off the call. If you’d like to learn more, check out our consultation page for details.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments are closed.